In professional trading, speed is not a feature.

It is the foundation.

A few milliseconds of delay can be the difference between profit and loss. A momentary system freeze can invalidate hours of strategy planning. And instability during long trading sessions can quietly erode performance without obvious warning signs.

Yet many trading desks and quantitative teams rely on systems that are powerful, expensive, and still not optimised for low-latency performance.

Why Trading Workloads Are Different from Other Enterprise Use Cases

Trading systems do not behave like creative or general enterprise workstations.

They demand:

- Ultra-low latency execution

- Consistent performance over long hours

- High uptime and system stability

- Multi-monitor output without degradation

- Predictable behaviour under continuous load

Unlike burst-heavy workloads, trading systems must perform flawlessly and repeatedly, often for entire market sessions without interruption.

The Common Mistake: Chasing Raw Power Instead of Responsiveness

Many professional traders assume that higher specifications automatically reduce latency.

More cores. Faster GPUs. Larger memory pools.

In reality, low-latency performance depends far more on system balance and tuning than on raw power.

Common missteps include:

- CPUs with high core counts but lower per-core performance

- Overclocked systems that sacrifice stability

- GPUs chosen without considering multi-monitor efficiency

- RAM configurations optimized for capacity instead of latency

- Storage systems that add unnecessary delays to data access

These choices may look impressive on paper but introduce unpredictability in real trading conditions.

CPU Priority, Clock Behaviour, and Predictability

For trading and quant workloads, CPU behaviour matters more than headline specifications.

Key considerations include:

- Consistent clock speeds under sustained load

- Low-latency cache access

- Predictable thread scheduling

- Minimal background interruptions

Systems designed without understanding these factors often show micro-stutters, delayed order execution, or inconsistent responsiveness that directly impacts trading outcomes.

Memory Stability Over Maximum Capacity

While large datasets are common in quantitative analysis, trading systems benefit more from stable, low-latency memory than maximum RAM capacity.

Issues arise when:

- Memory profiles are pushed aggressively

- Stability is compromised for marginal gains

- RAM configurations are not validated for long sessions

In trading, a stable system that performs consistently is always preferable to a faster system that behaves unpredictably.

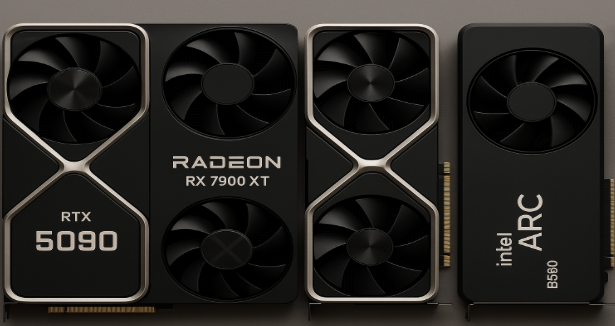

Multi-Monitor Setups and GPU Selection

Professional trading setups often rely on:

- Multiple high-resolution displays

- Simultaneous data visualization

- Continuous chart updates

- Low-latency rendering across screens

GPUs chosen without this use case in mind can introduce:

- Display lag

- Driver instability

- Thermal throttling during long sessions

Selecting the right GPU is not about maximum graphical power.

It is about efficient, stable output across multiple displays.

Why Uptime and Thermal Stability Are Non-Negotiable

Trading systems are expected to stay operational for extended periods without failure.

Thermal instability leads to:

- Clock fluctuations

- Increased latency

- Reduced component lifespan

- Unexpected shutdowns or throttling

Systems designed for gaming or short bursts often fail under this sustained stress.

At Digibuggy, trading systems are built using an engineering-first approach, prioritising thermal headroom, power stability, and predictable behaviour under continuous load.

The Role of Consultation in Low-Latency Trading Systems

Low-latency systems cannot be assembled using generic templates.

They require a deep understanding of:

- Trading style and execution methods

- Software platforms used

- Data flow and update frequency

- Session duration and load consistency

- Risk tolerance for instability

This is why Digibuggy follows a consultation-first process, where system design begins with understanding how traders and quant teams actually operate.

You can explore this consultation process here

Experience Matters When Downtime Is Expensive

Trading environments leave no room for trial and error.

Digibuggy’s system design philosophy is shaped by 25+ years of PC building experience and over 45,000 builds, including systems created for uptime-critical and performance-sensitive workloads.

That experience helps prevent issues such as:

- Over-tuning components beyond stable limits

- Ignoring long-session thermal behaviour

- Underestimating power delivery needs

- Choosing components that degrade performance consistency over time

Learn more about Digibuggy’s approach here

Support, Transparency, and Enterprise Readiness

Professional trading teams need more than hardware.

They need reliability and accountability.

Digibuggy supports this through:

- Online consultations across India

- Pan-India shipping and enterprise fulfilment

- Transparent system design and build process

- Guided configurations for stability-first setups

- Offline experience zone for validation ,where required

You can also explore real builds and insights on Digibuggy’s Instagram

Building a System That Does Not Get in the Way

The best trading system is the one you stop noticing.

It responds instantly.

It stays stable.

It performs the same way every session.

Before finalising your next trading system, ask:

- Is this system optimised for low latency or raw power?

- How predictable is its performance under long sessions?

- Have we validated stability over peak trading hours?

- Are we designing for uptime or benchmarks?

Expert-led consultation helps answer these questions before they become costly problems.

Frequently Asked Questions

1. What makes a trading PC different from a regular high-performance workstation?

Trading PCs prioritise low latency, stability, and predictable performance over raw processing power. They are designed to maintain consistent responsiveness during long trading sessions with minimal interruptions or delays.

2. Does a more powerful CPU always reduce trading latency?

No. Low-latency performance depends on consistent clock behaviour, cache efficiency, and system tuning. CPUs with high core counts but lower per-core performance can sometimes increase latency in trading applications.

3. How important is RAM selection for trading systems?

RAM stability and low latency are more important than maximum capacity for most trading systems. Unstable or aggressively tuned memory can introduce micro-stutters and inconsistent performance during live trading.

4. Why is consultation important for building trading systems?

Consultation ensures that trading systems are designed around actual trading workflows, software platforms, and session behaviour. An expert-led consultation helps prevent instability, reduce downtime risk, and optimise systems for predictable low-latency performance.